We advise on the entire capital raising process, from preparation to investors’ introduction and negotiation.

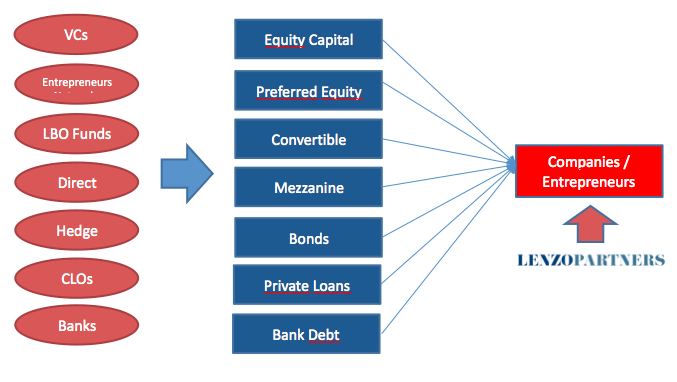

Banks’ distintermediation has led to the emergence of multiple sources of funds and complex financing solutions.

Our goal is to assist entrepreneurs in defining the most efficient financing solution for the development of their business which includes introducing them to the most relevant investors/partners and negotiating the most favourable terms for their shareholders.

Phase 1 : Preparation

Conduct an extensive preparation phase: We believe preparation is the most important phase of your capital raising. As an entrepreneur, your focus is on the execution of your company’s strategy and commercial development, not on drafting business plans, financial modelling and preparing financial marketing materials. Hence, we intervene very early-stage in your capital raising effort, we draft your business plan, help you define your financing needs, identify the best source of capital and prepare marketing materials. Through this extensive phase, we ensure that your company meets investors at the right time, with the right proposition and the best marketing tools

Phase 2 : Roadshow

Introduce your company to a defined investor base and establishing the right balance between competitive intensity and timing.

Phase 3 : Negotiation

We bring balance back to the negotiating table. As an entrepreneur, you are an expert in your field yet have very little interaction with potential investors who operate under their own standards. Our experience allows us to take on this important task ensuring to build bridges between these two very different worlds and allowing for a discussion on a more equal footing while maintaining a trusting relationship between entrepreneurs and investors.

Preparation

• Business Review • Understanding financing needs • Preparing Business Plan • Drafting Marketing Materials • Defining best structure and timing • Educating management

Third party meetings (investors, targets,…)

• Preparation of management • Preparation of Q&A • Organization of roadshow

Due Diligence

• Preparation of legal and financial documentation • Business Due Diligence • Coordinating lawyers, auditors,…

Negotiation & Closing

• Negotiation of documentation